Finance can be defined as the branch of economics dealing with the management of money and other assets.

Finance can be defined as the branch of economics dealing with the management of money and other assets.

The management of credit and banking and the commercial activities of providing funds and capital for investment also fall under the umbrella of finance.

The Effective Management of Assets

Finance is the pivotal feature of any business organization which has the utmost responsibility of raising funds for its corporation with practicing a stable balance between risk and profitability. Real Estate Finance can be defined as a branch of economics which deals with investing money or wealth acquisition in real estate. It is the allocation, generation, and use of monetary resources over time which is invested in the real estate business. Like any other aspect of finance, real estate finance also has risks associated with it –the effective management of assets, which will maintain or increase in value over time, will eventually result to a good investment yield of the project.

The Difference between Real Property and Personal Property

Real estate investment essentially means investing in immovable properties such as land and everything attached to it such as buildings, also known as properties. The difference between a real and personal property (called chattels) is the right for the transfer of title to the property in question in real property whereas the right to personal property or ownership to personal properties cannot be transferred.

Real Estate Can Be Used to Secure a Loan

Real estate investment can be viewed as a handsome business opportunity as real estate can be pledged as collateral to secure a loan for a business venture, to offset otherwise taxable income through cash savings on tax-deductible interest rate losses or rental income can also be derived from a real estate property. A common example of real estate financing occurs whenan individual owning multiple pieces of real estate and use one as his primary residence while others can be rented out. Profits, known as capital gains from real estate financing, can be reaped from real estate financing as a result of appreciation of real estate property prices.

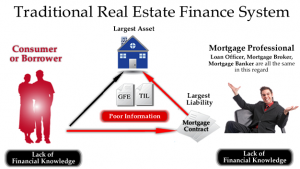

Real estate financing is long term in nature and investment professionals have always maintained that at least 15%-20% of one’s investment portfolio should be devoted to real estate. Real estate financing can either be on residential or commercial properties, which have different tax implications. Real estate investment and financing decisions are inextricably linked and equity investors or borrowers treat real estate investment as much as a financing decision. The most recent development in the field of real estate finance has been the rise of real estate mortgaging business. A mortgage is defined as the conditional pledge of one’s property for the repayment of a debt obligation or a loan. The borrower is called the mortgagor and the lender, the mortgagee.