As mortgage rates continue near historic lows and the real estate market continues to recover from its historic slump, foreclosures across the country have experienced a significant decline over the past 12 months. But despite the fact that foreclosures are down, on average, across the U.S., certain states continue to see high levels of foreclosure activity. The state of Maryland, for example, continues to see above average foreclosure activity – a trend to which there is no immediate and in sight.

As mortgage rates continue near historic lows and the real estate market continues to recover from its historic slump, foreclosures across the country have experienced a significant decline over the past 12 months. But despite the fact that foreclosures are down, on average, across the U.S., certain states continue to see high levels of foreclosure activity. The state of Maryland, for example, continues to see above average foreclosure activity – a trend to which there is no immediate and in sight.

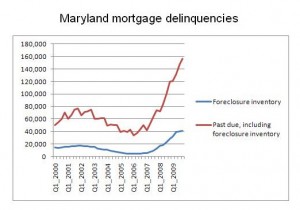

In March 2014 Maryland had the second highest foreclosure rate in the country. On a statewide basis one out of every 527 homes had some form of foreclosure activity during the month, which represented the 21st consecutive month that the state had seen increasing foreclosure activity. Now, Maryland ranks only behind Florida for the percentage of homes which are affected by foreclosure on a monthly basis.

As a result of the significant foreclosure activity in the state, Maryland has seen distressed properties become a significant part of the state’s overall real estate sales activity. In March an estimated 23% of closed real estate deals involved a distressed property. The high percentage of distressed properties being sold in the state is being blamed for the lack of appreciation of real estate in Maryland’s major cities such as Baltimore.

According to RealtyTrac, a real estate industry tracking firm, Maryland is one of only a handful of states which continues to see increasing foreclosures. The state’s 2,634 new foreclosure starts in March were up 19% from February’s total, and up 28% from the state’s total from a year earlier. Officials are blaming the state’s high foreclosure rates on the fact that the state suspended foreclosure filings during the height of the “foreclosure crisis”, creating a backlog which is just now being worked through.

For more from the Baltimore Sun, click here.